If your business is considering accepting card payments but isn’t sure where to start or how the process works you’ve come to the right place. Wireless Terminal Solutions are an independent provider thus meaning we can support you and your business to maximum effect and with every sales opportunity. Merchant accounts are used to process card payments and deliver funds to your business bank account.

Is your business looking to start accepting card payments?

Start Accepting Cards to maximise sales opportunities

At Wireless Terminal Solutions, we specialise in providing merchant accounts for both small and large businesses. Our credit and debit card payment solutions are tailored to your business needs and we make the process of setting up a merchant bank account service as easy as possible.

What ways can a business accept card payments?

There are 3 main ways. These are:

- Phone

- Online (often referred to as a virtual terminal)

- Card Machines

We can support business in all aspects of this. Please note not every business will require all three of these aspects, and the majority of customers will generally settle on one with accepting card payments via card machines being the most popular.

Merchant Account Support

Wireless Terminal Solutions support all of our customers through the boarding process, and we have most companies operational in typically three working days – which is much quicker than a lot of merchant providers in the UK.

What is a merchant account and how does it work?

A merchant bank account is created under a contract between an acceptor and a merchant acquiring bank for the settlement of credit or debit card transactions. The acquirers make sure the funds are available on the payment card being used, and look after the whole process through to settlement into your account. If your business is just getting off the ground, and you have concerns over the long term stability, it’s a good idea to keep things simple and avoid signing up for lengthy contracts.

How do I access money that is paid into my merchant account?

When a business accepts card payments the money is automatically processed into your merchant account, and then onto your business into the nominated business bank account where you can access the necessary funds.

Payment gateways – what are they?

Payment gateways meet the demand and play a central role in processing debit and credit card payments, authorising the payment between merchant and customer. The payment gateway will show whether the payment has been authorised and then print off the necessary receipt.

Getting started with Merchant Accounts

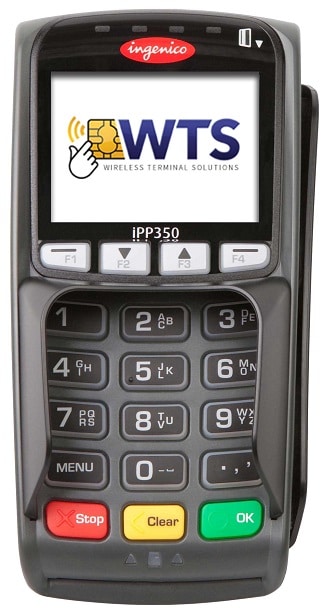

Our customer operatives will ask you to complete some short simplified paperwork and sign which can be returned via e-Signature, so there is no hanging around. Once the merchant bank account is approved, we can generally dispatch the card machine within 24 working hours. Depending on the PDQ terminal you opt to rent or lease, all you generally need to do is switch it on, and you’re ready to start processing card payments –and the credit card machine is automatically linked to your merchant acquirer. We supply a wide range of payment card machines including countertop card terminals, portable, Wi-Fi and mobile handsets. We ensure every credit card machine comes with ongoing technical support in and out of hours, to give you peace of mind.

What is the process for setting up a merchant account?

Setting up a merchant account and accepting card payments is incredibly simple with Wireless Terminal Solutions. We manage and support customers in all aspects of the application making the process as straightforward as possible.

- Call our dedicated UK based merchant service team on 0345 459 9984. We will then price up in accordance to the nature of business and how you sell

- The quote will be sent in an email detailing all merchant service charges and if happy, an application document is sent to customer and this is returned

- Application is sent is for approval

- Merchant account number is generated

- You’ll then receive your new card machine within 24-48 hours! Your credit card machine comes with FREE ongoing technical support that includes evenings and weekends.

Is the merchant application process the same if I went elsewhere for my card processing facilities?

In essence yes but not all companies will deliver an account manager who manages all aspects of the application. Part of our unrivalled success is the relationship and rapport we build with customers. We don’t just get to know your business, we get to know you. Regardless of which supplier, bank or company you deal with, the process is exactly the same (the customer completes the application process and then the application is sent to the acquiring bank to be reviewed pending approval).

In essence yes but not all companies will deliver an account manager who manages all aspects of the application. Part of our unrivalled success is the relationship and rapport we build with customers. We don’t just get to know your business, we get to know you. Regardless of which supplier, bank or company you deal with, the process is exactly the same (the customer completes the application process and then the application is sent to the acquiring bank to be reviewed pending approval).

At the end of each calendar month you will receive a merchant bank account statement. This will detail all of your transactions, card sales, refunds and any other costs. The funds from purchases made by customers will automatically be transferred into your business account in full from one to three working days of the transaction taking place.

To get more familiar with merchant accounts (and all of the terminology surrounding merchant card processing), use our handy glossary terms guide on our website which you can access via our homepage.

What Types Of Credit Cards Does Your Business Want To Accept?

Mastercard and Visa are standard with any merchant card processing account, but is it important for your business to also accept other card brands, such as American Express? Factor in a list of credit card brands that you want to accept.

What Other Card Processing Fees Do I Need To Consider?

There can be many other fees associated with a new merchant account beyond the traditional MSC (merchant service charges). Just a few other fees to ask about include the following:

Monthly minimum fees – Most merchant account providers charge a minimum monthly fee if the total transaction processing fees for the month do not add up to a minimum amount. The minimum monthly fee varies by providers but usually costs £20-£30

Setup fees – Ask what the set up costs are for the merchant account. Some companies have been known to charge up to £250!

Cancellation fees – In the event your business model changes, or you cease trading what charges will you incur if you cancel the merchant account.

Other charges you need to monitor are – chargeback fees, statement fees, annual fees relating to the account and customer service fees.

Offer Contactless For Small Payments

Contactless card payments have revolutionised the payment industry, and have become extremely popular in the UK now. For merchants, contactless payments have two major benefits. They are quicker so it enables you to serve more customers in less time, and they can be slightly cheaper to process. If you are thinking of replacing an old card machine that doesn’t offer the contactless facility, this is an extra reason to do it now.

Wireless Terminal Solutions can also provide a dedicated online payment portal, allowing all payments to be monitored/accessed 24/7. Most merchant providers only supply hard copy statements, but we provide this facility free of charge, and it can be accessed remotely. The payments are tracked by your TID (Terminal Identification Number). Contact us now on 0345 459 9984 and let us guide you through the process from start to finish. Alternatively please head over to our Merchant Services page for more information.

Merchant Accounts: Frequently Asked Questions

What are the pitfalls of getting a merchant account?

How easy is it to get a merchant account?

How easy is it to accept Amex card payments?

Why don’t all businesses accept Amex card payments?

Can I still apply for a merchant account if I’ve been rejected previously?

I’ve been rejected for a merchant account but want to accept card payments what can I do?

What is a high risk merchant account?

What are the pitfalls to having a high-risk merchant account?

Can I get a merchant account with bad credit history?

Do I need a merchant account?

How long does it take to get approved for a merchant account in the UK?

Do you need a merchant account to accept debit cards?

What credit card charges do small businesses pay?

- MSC - Merchant service charges - Generally a fixed charge on every debit and credit card transaction.

- The rental charge for your card machine rental - This is generally a monthly or quarterly charge and will vary on the card machine supplier you go through and the length of period you enter into.

- Authorisation Fees - Additional charges may apply for every authorisation on each card transaction.

- PCI DSS - If you are a small business owner and your small business intends to accept debit and credit card payments, whilst processing and transmitting cardholder data, you will need to host your data securely with a PCI compliant hosting provider. This is a monthly charge.

- Set up fees - This won't apply to everyone, but some merchant acquirers will charge to set up a merchant account.

- Minimum monthly spend - The minimum monthly spend is a minimum fee which will be applied by an acquirer where their merchant service charges haven't been met. This will be detailed in the application.

- Termination fee - If you think there is a possibility you may end the agreement early we would advise checking on what fees would apply if your small business was to end the agreement early.

- Chargeback Fees - What admin and charge back fees will you incur in instances of a customer or individual requesting a chargeback.