Apple Pay was introduced to the UK in July 2015 following the official launch in the US in 2014, and has become extremely popular and hugely topical for retailers and food and drink establishments.

Apple Pay is designed to change the way customers shop. Apple are trying to revolutionise credit card payments, moving consumers away from the traditional need to carry around lots of credit cards.

Apple Pay has struck a deal with Transport for London (TFL) where you can use your watch or phone to travel around on the Tube, bus and rail networks. You can also use Apple Pay to make single touch purchases within apps and via card machines. Starbucks, Subway, Wagamama, Waitrose, CostCutter and JD Sports are just a few retailers who accept Apple Pay via their card machines.

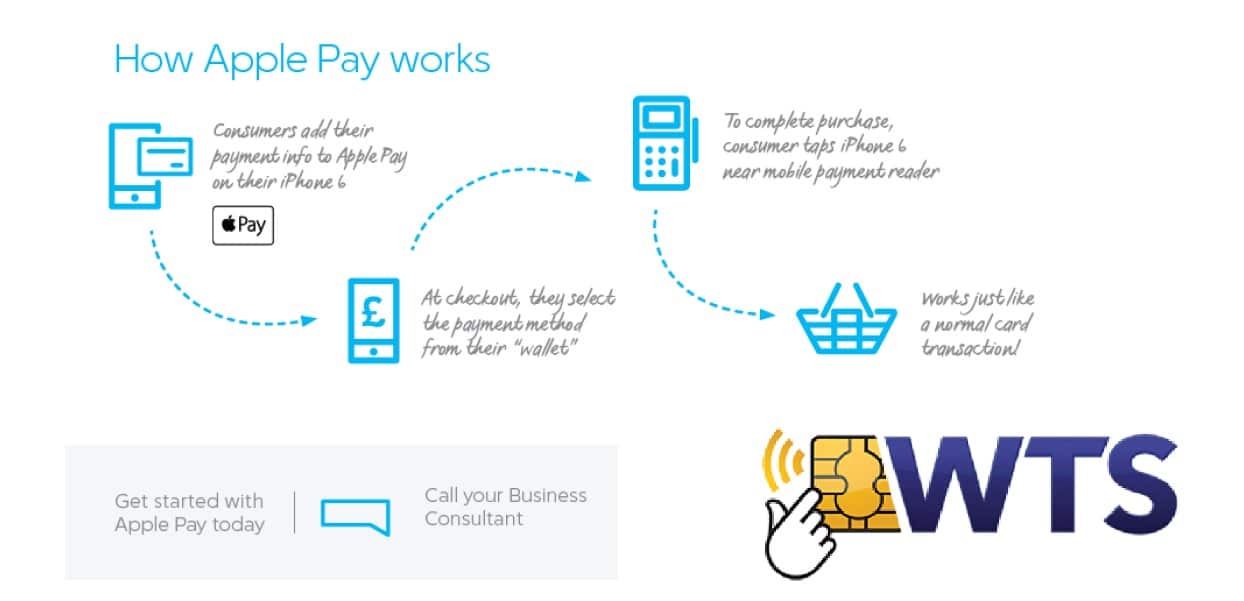

How Does Apple Pay Work With Card Machines?

Apple Pay uses the near-field communication (NFC) chips embedded in your iPhone 6, iPhone 6 Plus and Apple Watch to pay for goods and services by holding the device near a credit card machine or reader, as you would a contactless debit or credit card.

You don’t need to enter your PIN to verify your identity – the technology follows the same experience as on our contactless card machines.

Approaching a card reader with your smartphone automatically wakes up Apple Pay – without having to open an app. You then press your finger to the sensor and it verifies the payment using the credit or debit card details you have already set up. Your phone will beep to let you know it’s been received.