Merchant services is a broad category which consists of various financial services solely intended for the use by a business as required. Merchant services will enable a business to accept debit and credit card payments using a secure platform. There are multiple ways a business may opt for merchant services whether this is online, mail order telephone order or face to face. **

What are Merchant Services?

Wireless Terminal Solutions make the Merchant Services application refreshingly simple...

In such a fast paced setting, it can be hard for business owners to focus their attentions elsewhere. Our aim is to offer customers a straight-forward sign-up process for merchant services. With our extensive industry experience and wealth of knowledge, we have created a simple application process, which is coupled with your own account manager who will support you with all aspects of the application. We will help answer any questions you may have, and take you through the process to ensure we get you and your business set up with merchant services as quickly as possible.

Everything you need to know about Merchant Services

The area of merchant services can appear daunting from an outsider looking in and can appear complicated to business owners and cause confusion amongst business owners with so much to choose from.

Wireless Terminal Solutions are experts in the area of merchant services, and we hope to make things as simple as possible for our customers.

Are business bank accounts the same as merchant accounts?

Put quite simply, no! Business owners sometimes confuse merchant accounts with bank accounts. They are two totally separate entities. A bank account is where your business funds are stored. A merchant account is a credit account arranged between the merchant and acquiring bank. Not all acquiring banks offer the same merchant services.

Merchant services misconceptions

There is a common misconception that you need to get your merchant services from the bank your business account is with. This is not the case – you can bank with one financial establishment and have your merchant services account with another. There is no extra cost to have this facility. This allows you to shop around for the merchant service best suited to your needs.

Every business who wants to accept merchant services will need a merchant account. Here are just a couple of key benefits to using our merchant services:

Added Card Security

We protect your payment data so you can concentrate on running your business.

Fast Payment Settlement

In some instances we can offer customers same day settlement on transactions into your business bank account.

Competitive account rates

We offer modest merchant service charges that never break the bank.

Accept a whole host of payment types

Our merchant services will allow your business to accept multiple ways of accepting card payments including Visa & Mastercard amongst others.

Offer flexible payment options for your customers

By choosing merchant services you aren’t restricted to cash only transactions, nor will you be dependent on cheques or to take invoices.

Take advantage by accepting all debit and credit cards

Let your business take advantage of the latest card machines combined with contactless enabled technology.

PCI DSS Compliant

All our products and merchant services are PCI DSS compliant meeting global anti-fraud standards.

Can I switch from my current merchant services provider to Wireless Terminal Solutions?

Yes, it is now extremely easy for a business to switch their merchant services to Wireless Terminal Solutions and 2018 has seen more customers switch their merchant services than any previous year. If you want to follow suit like many hundreds have, we have great potential savings waiting to be explored. This could be for businesses looking to change their face to face payments, e-commerce or MOTO payments. We make the switch painstakingly easy, and your business can be equipped with the latest card machine with contactless enabled technology in a matter of days.

Why choose Wireless Terminal Solutions as your Merchant Services provider?

With a collective industry experience amassing 80 plus years, the team at Wireless Terminal Solutions are experts in all aspects of merchant services. Whether you are new to cards, looking at switching providers and saving money whilst receiving a better service or you are looking for a bespoke quote or you just want some additional information we can support your enquiry.

We can arrange the whole process on your behalf. With our wide range of merchant services, you can boost sales, streamline your administration and even broaden your client base by accepting credit and debit card payments online. After you complete a simple merchant services application form, we then liaise directly with the merchant acquirer to set up your account. Everything is detailed meticulously and there are no hidden extras. Once you have the merchant account set up, you will receive a statement at the end of each month detailing all of the credit activity on your account.

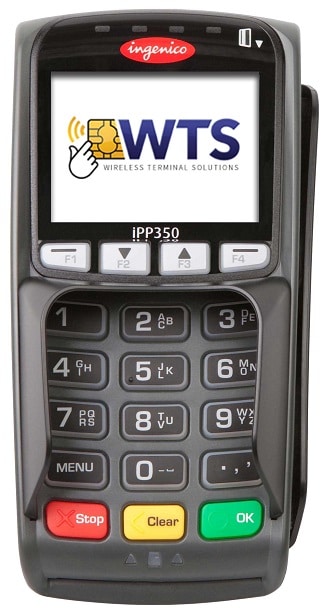

Card machines for Merchant Services

We don’t just offer an expansive range of payment acceptance solutions, but are renowned for our expansive versatile card machine solutions to meet your needs regardless of how you trade or operate. We offer four main types of card machine: mobile, countertop, portable and Wi-Fi. Whether you want to accept card payments in person, on the go or over the phone, we have the right solution to meet the needs of your business which all comes with UK based technical support.

We have most applicants up and running with their merchant service requirements in three days* and as soon as the account is approved, the credit card machine is deployed from our Surrey headquarters. We are an official reseller to the UK’s leading card manufacturer Ingenico and our card machines are accredited with every UK acquirer bank.

Learning more about Merchant Services

Wireless Terminal Solutions can help you take secure credit card payments over the phone, on the move, or in person. Whatever your business sector, our ultimate commitment to the customer is to help you choose the right merchant service for your business.

We offer credit and debit card payment solutions as well as merchant services, to businesses of all shapes and sizes from sole traders to major blue chip organisations.

To find out more about our merchant services click here, or contact us today to see how we can help.

*figure is based on application lead time for 2018

**Citation – source Wikipedia – https://en.wikipedia.org/wiki/Merchant_services

Merchant Services FAQ

What are the benefits to having merchant services?

What are merchant services?

What are some of the key advantages to having merchant services?

- The ability to accept card payments from customers

- Merchant services increases sales because customers are not restricted to cash only purchases

- Merchant services provides new opportunities for sales via telephone mail order and online

- Increased impulse purchasing opportunities as people go from browsers to buyers